“The US unemployment rate is still hovering near a 50-year low.”

Wage growth is back on track with figures that rival the booming ’90s — the latest Jobs Opening and Labor Turnover (JOLTS) report boasted a mighty 8.8 million job openings, and the Bureau of Labor Statistics (BLS) reported that the US economy added 216,000 jobs in December 2023.

But before you break out the confetti, it’s worth taking a deeper dive into these numbers. As this is an election year, a closer analysis yields some disappointing trends, especially in the life science sector.

Biotech Beatdown

Biotech, typically a hotbed of innovation and growth, has indeed been facing its own set of specific challenges. According to Fierce Biotech, more than 177 biotech companies in the U.S. laid off employees in 2023. Biopharma Dive says the number of individuals displaced is upwards of 10,000, and the sector has been grappling with both weaker public market capitalization as well as less venture capital investment.

The Dark Side of the Story Continues

At the beginning of 2023, the number of jobs in the U.S. life sciences sector reached a historic high of 2.1 million (BLS.gov). However, the pace of hiring has slowed from upwards of 6% in 2022 to 4% in 2023. This however is an estimated number, and it should be noted that the BLS’s employment figures were revised downward for every month in 2023, so one can’t take much stock in the headline “jobs” print. This unfortunately contributes to the suspicion that many feel: the actual unemployment rate may be higher than what the BLS is reporting.

Further, while the JOLTS report touts job openings, it obscures the fact that many of these new jobs are part-time, low wage, and government roles. Think Uber drivers, app delivery workers, and Amazon warehouse associates—or in biotech’s case, contract lab service workers and temporary manufacturing technicians. These are lower-paying, sometimes non-benefited jobs. The majority of job cuts have hit white collar roles especially hard in the areas of General and Administrative (G&A), Research and Development (R&D), and commercial sales.

Automation, Machine Learning(ML) and AI Encroachment

Exponential improvements in AI and automation are a growing threat to many areas of employment in life science. According to CBRE, AI’s impact across Life Sciences and Laboratories will generate more automated systems in the laboratory than has been seen in the past. This will likely lead to more centralization, and the words, “automation” and “centralization” almost always mean fewer people needed (Will AI and Automation Disrupt the Lab? 8/23/23). ML models can enhance molecule selection and tailor designs for new disease targets. This is resulting in more drug discovery and quicker approvals as highlighted in a recent KPMG analysis. The traditionally lengthy steps of developing drugs and vaccines–—a process that typically takes 10 years has shrunk dramatically, in some cases even less than a year, with these advances in AI and automation.

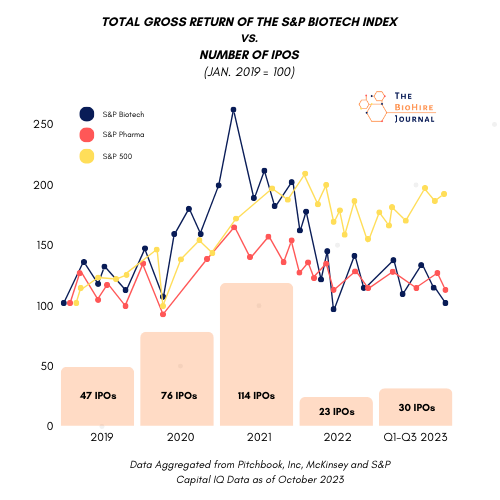

Biotech Returns Past and Present Lag the Market

In his eye opening commentary, Biotech Returns, 30 years of disappointment, Nicholas Rabener explains that there have only been a few time periods where the XBI (Biotech) has out performed the overall Composite NASDAQ: 1999-2000 and then again between 2011 and 2015. A brief outperformance in 2021 has subsequently led to a more recent sharp decline.

Sharp declines in biotech stock valuations and IPO funding signal a notable market shift to less risky, less regulated segments. Couple this with a frenetic increase in interest rates and you have a perfect recipe for investment malaise in “risk on” segments like life science.

And while Rabener concludes that biotechnology has not proven to be lucrative for many investors thus far, he admits that it is poised to have a significant influence on our lives as it continues to advance from basic cosmetic improvement to meaningfully extending human lifespans. As such, it remains compelling from the perspective of employment as there is still so much unmet need on a global scale.

Biotech Silver Linings

Don’t let the headlines discourage you—there are plenty of reasons to be upbeat about the future of employment in life science and the business of biotechnology.

- The Bureau of Labor Statistics (BLS) anticipates a strong job outlook for medical scientists, with a projected 17% growth from 2021 to 2031, faster than the average for many occupations, potentially leading to around 10,000 job openings annually.

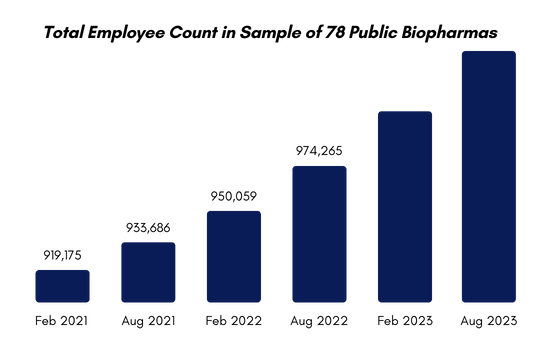

- Despite the doom and gloom headlines about lay-offs for early-stage biotech companies, big pharma continues to grow, with an 11.6% rise in employee count between spring 2021 and summer 2023, equating to 96,000 new jobs. Overall, headcount in the industry as a whole is growing, not shrinking.

- The XBI (Biotech) Index closed at 90.4 on January 12th, 2024, far above the 60s and 70s of Q4 2023. Stifel says the market has bounced back by over 39% since the market tanked in late October 2023.

- Betting odds are that the FOMC will hold interest rates steady or lower them 2024, providing some relief for fundraising efforts.

- According to Leering Partners, a historically high number of small to mid-cap North American biotech companies are trading below their cash holdings, suggesting undervaluation and potential for growth. This implies a potential market bottoming.

- The general sentiment at the JP Morgan Healthcare Conference was that the biotech industry is on an upswing, with mergers and acquisitions leading the charge. According to Ernst & Young, M&A investment totaled $191 billion in 2023, an increase of 34% from 2022 and 2024 is off to a very brisk M&A start fueled by topline pressure and a looming patent cliff on key products.

In conclusion, while the job market may present challenges, the biotech sector seems poised for a rebound even amidst signs of a looming recession. Staying informed and adaptable is key as we navigate the complex landscape of employment and economic trends.