Navigating the Complex Landscape of Biopharma Employment

After a decade at Pfizer, immunologist Mary Sutton was laid off in February. Sutton (not her real name) has been looking for another mid-level executive position in new drug development since getting the WARN notice 60 days before, applying for jobs in pharma and large biotech companies. While most of her colleagues have found work since the layoff, it’s taking longer than she’d hoped. “There are jobs out there, but a lot of people as well,” she said.

Sutton is going through her network when applying to jobs, trying to find connections who can give her an in. She’s talked with some recruiters as well. Sutton is far from unique in this situation. The biopharma industry is going through a shakeup. Large pharma companies are going through their own paring and hiring processes, with a wave of 2024 layoffs that include 1,500 peer layoffs at Pfizer, 2,200 layoffs at Bristol Myers Squibb, 1,500 at Bayer and 1,000 at Takeda, according to Brian Buntz, the pharma and biotech editor at WTWH Media. These companies are still hiring, but for different roles and programs.

Biotechs are going through their own process as well. They raised almost $3 billion in the first quarter of the year, per Buntz, but many biotechs are laying off a significant number of staff members as well—not all are successful in the fundraising process.

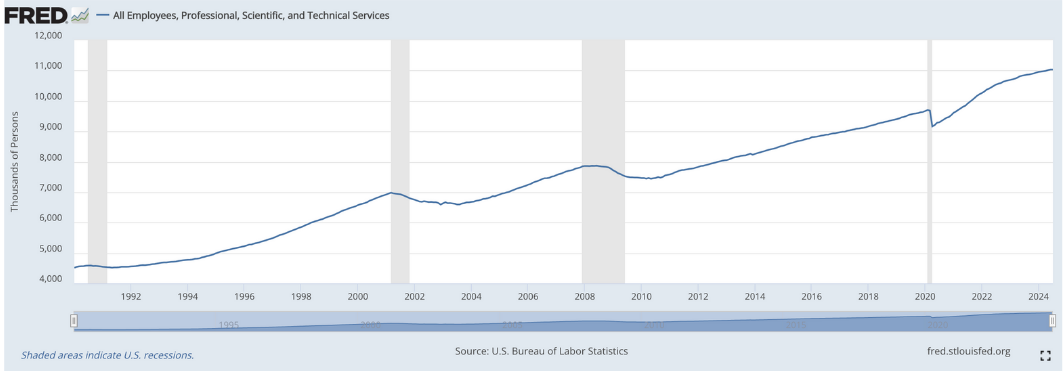

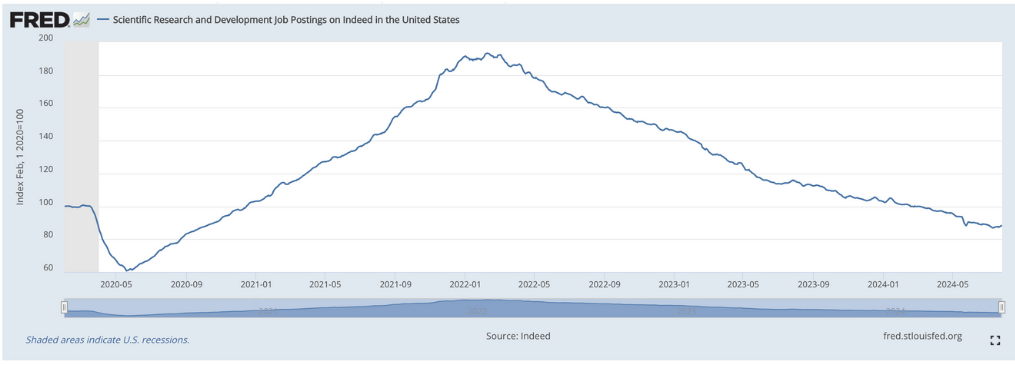

Indeed data posted by the Federal Reserve Bank of St. Louis, shows a continual decrease in new scientific research and development jobs as of mid-July, from a peak in early 2022. Yet the Fed’s published data from the U.S. Bureau of Labor Statistics shows that employment in the scientific technical sector has been growing at mostly uphill trends since at least 1992.

U.S. Bureau of Labor Statistics

Federal Reserve Bank of St. Louis

Reinvention and reorganization

One reason for layoffs is pipeline strategy realignment. “In the pharma and biotech industry, you have to reinvent yourself every decade, because patents expire and when they don’t have products behind them, you see downsizing,” said Javan Collins, founder and CEO of VANIGENT BioPharm. “There is more pressure on pharmaceutical companies because of payer pricing, and this is challenging margins. I think companies are looking to be more effective and efficient.”

That includes culling staff based on clinical trial results and drug program closures or expansions. The major biopharma regions are sharing the layoff pains, including California, Massachusetts, New York and New Jersey.

What’s different now?

Shamway Ho was laid off from a small Boston biotech in December. With a career spanning two decades at multiple pharma companies, the mid-career director-level scientist voluntarily left one big pharma in 2022 to move to this biotech. Ho (not his real name) enjoyed his time at the smaller company, but found a different hiring scene when emerging from the layoff. 2022 was a candidate’s market and he had more leverage then.

When interviewing this year, Ho found a different scene. “There’s a lot of competition. Positions I interviewed for and was qualified for, I was surprised I didn’t get an offer. They ended up hiring someone else,” he said. He landed a job at a pharma company and is now in the hiring manager role seeing the other side: he is choosing from many qualified candidates.

With a plethora of talent available, some companies want to interview as many candidates as possible, increasing the cycle time for each position. “It’s often hard to choose between the best candidates,” said Eric Celidonio, founder and senior managing partner of Sci.bio Recruiting. “The dynamics have completely reversed from the 2021 job boom. There was a lot of candidate scarcity and sometimes three competing offers for each candidate available.”

It’s a buyer’s market

In this new biopharma market, fewer candidates are being relocated and even fewer who need visa or work authorization are being hired, Celidonio said. “You’re seeing more lateral moves and in some cases, even demotions.” Given the quick growth in 2020 and 2021, some candidates who were less qualified received inflated titles and now are settling for more realistic ones.

While Ho could negotiate for more money or other compensation in 2022, this job search was different.

“It’s clear now, there’s no negotiation,” he said. “When you get an offer, it’s firm. When you’ve looked for a job a few times, you get a sense for when you can push back and when you can’t. And at this time, you can’t.”

This matches what Collins is experiencing on the hiring side. While salaries have not decreased, “we do see less negotiating and expectations, more aligned to the market. And some candidates are willing to trade off compensation for greater flexibility, such as being remote,” he said.

Sectors to watch

Well-funded startups are hiring, said Ho, though not all startups are in the same position. He’s seeing more jobs in translational medicine. Clinical development is increasingly specialized, with a higher percentage of people holding MD or PhD degrees. Basic bench science jobs are harder to come by, he said.

While there are not many rare disease companies, they are all in, she said, with some drugs for rare disease returning the investment. As weight loss drugs have experienced success, others are trying to push into that space, especially since these GLP-1s have the potential for multiple indications. “If companies are close to having a product, or are in late clinical development, they are hiring for marketing.”

With consolidation in small biopharmas, many of the white-collar executives, some of whom were first time members of the C-suite, will have a harder time landing quickly, given the dynamics, said Celidonio. This is leading some to move out of pharma and biotech. Typically, once you’re in this business, you retire in it, said Collins. “We’re now finding people shifting out of pharma and biotech, which is alleviating some of the pressure and excess capacity that might exist,” Collins said. Those leaving are often going into ancillary healthcare businesses, whether insurance companies, pharmacy benefit manager companies, or hospital systems. “The skill sets are very attractive to certain other types of industries.”

There’s still high demand in blue-collar segments, though, said Celidonio. Buntz’s research backs this up. The research found that the jobs most frequently posted in this industry were research associate, validation engineer and microbiologist. Validation engineer roles are common in manufacturing regions, and Collins believes the biggest growth in industry jobs is in manufacturing. “More pharma companies are developing plants and putting manufacturing in the U.S.” Collins said.

Some things don’t change

Current unemployment trends confirm that it’s still more desirable to hire a candidate who is working versus one who is unemployed, even if their résumé looks great.

“There is a general suspicion of anyone who’s been unemployed for a long period of time. It’s human nature to think that something could be wrong with that individual. “Any time there are two equally qualified candidates, the one who is working will be the one who is more sought after.”

The biopharma industry will continue experiencing growth and downsizing periods in the future. The wave is not easy to ride, especially for talent looking for work right now. As Sutton said, “I’m not feeling despondent, but I’m getting a little weary.”