LinkedIn Is Inundated With Fake Profiles

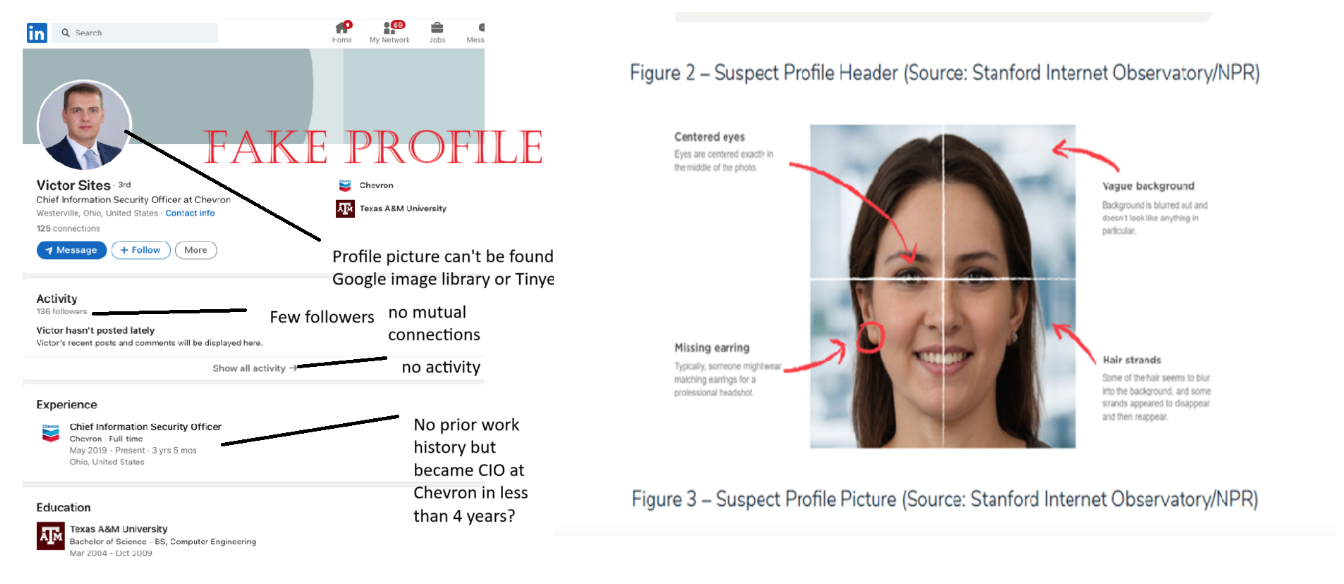

While LinkedIn claims to be working to prevent this, there are plenty of fakes slipping through the cracks. It seems that their defense systems are overwhelmed. Their claim of blocking over 121 million fakers last year sounds laudable but in the age of AI rapid-fire profile creation, it’s kind of a meaningless statistic. Bottom line: As a LinkedIn user, you need to be vigilant, as there are people using LinkedIn solely as an opportunity to harvest your data or worse, to outright scam you.

This isn’t just a nuisance and these fake operatives can pose a genuine threat: identity theft, spying, fake interviews, you name it. This is a threat to anyone on LinkedIn for job seeking, business or networking. Data shows LinkedIn’s filters are getting easier to bypass as estimates of one in four fakes are getting past their filters. So while LinkedIn stops a full-on crisis, they still have work to do to secure the platform.

For anyone using LinkedIn to recruit or make connections, it’s important to stay alert and double-check profiles, verifying information and sketchy messages. Things to look out for: no mutual connections, big titles, elite college credentials, and flawless or nonsensical job history, Pay careful attention to the photos—they are usually AI-generated or doctored.

Staffing Industry Stocks Hit Multi-Year Lows

The staffing industry has been taking a major hit, with stocks of many leading recruitment firms sinking to multi-year lows. Companies like ManpowerGroup, Robert Half, and TrueBlue have been particularly affected, signaling broader economic concerns and a noticeable hiring slowdown. This downward trend isn’t just a reflection of company performance; it could be part of a greater long-term consolidation in the labor market.

One of the main drivers behind this slump is employer hesitation. With economic uncertainty lingering, many companies are delaying hiring decisions, directly impacting staffing firms’ revenues. This isn’t just a U.S. problem—U.K.-based SThree recently issued a profit warning, pointing to sluggish hiring activity and worsening market conditions, which in turn, rattled the sector further.

Not all staffing firms are in a complete slump. Korn Ferry and ASGN Inc. have been less affected, perhaps in part due to acquisitions and some investor optimism. This hints at potential opportunities even in a tough market, but until hiring picks up and business confidence returns, staffing stocks will likely remain under pressure.

For recruiters and hiring managers, this industry-wide turbulence highlights the need to adapt to the “new normal”—where job openings are scarcer and AI and automation are increasingly replacing routine positions. The firms that innovate and pivot toward strategic workforce solutions—rather than relying on traditional hiring models—will be the ones that emerge stronger when the tide turns.

Quick Hits

By: Eric Celidonio

- Upcoming FDA Descion Dates (PDUFA): Here’s a summary of the FDA’s upcoming new drug approval dates.

- Is LinkedIn Still Working for Recruiters?: LinkedIn remains a top tool for finding talent, but has it become too chaotic? With personal stories, viral trends, and even dating prospects flooding feeds, recruiters must adapt to a shifting landscape. Learn how to cut through the noise, avoid burnout, and make LinkedIn work for you.

- Who’s Really Running the FDA? Interim Team’s Role in Questions: Amid leadership transitions, uncertainly surrounds the FDA’s interim team, raising questions about who holds real decision-making power.

- Trumps’s Policies Threaten U.S. Biomedical Talent: Trump’s latest policy shifts are stirring fears of a talent exodus that could compromise America’s edge in biomedical research.

- Biotech M&A Underwhelmed in 2024: Biotech M&A is poised for a rebound in 2025, with major deals kicking off the year and experts anticipating a surge driven by pipeline needs and economic conditions.

- NIH Cuts Challenge Researchers Despite Court Halt: Despite a federal judge’s temporary halt, the NIG’s proposed funding cuts continue to pose significant challenges for researchers, potentially disrupting ongoing projects and threating future scientific advanvements.

- Biotech Startup Funding Tracker: VC Trends & Investments: BioPharma Dive’s database offers an up-to-date overview of funding rounds involving 23 prominent venture capital firms, highlighting investment trends across drug types, disease focuses, and development stages.