If there’s one thing business owners and investors despise, it’s unpredictability. The once‑reliable rhythm of market cycles has been jolted by the global financial crisis of 2008, the COVID‑19 pandemic, and tariff‑driven geopolitical instability. Reports from both the World Economic Forum and the International Monetary Fund point to how these shocks have made long‑term forecasting less dependable, deepening volatility and leaving companies of every size grappling with uncertainty.

That uncertainty ripples well beyond balance sheets. Even historically stable industries—executive search and staffing services among them—have been forced to reinvent themselves. Under mounting pressure to adapt along with ebbing employment demand, established search brands have watched market share slip, losing ground to nimble, tech‑enabled upstarts promising similar results at lower cost.

In biopharma, early-stage companies feel the squeeze most. With neither the headcount nor the budget to build an in-house talent team, they rely on external vendors—and costs add up fast. But rushing a hire (or picking the wrong search partner) can be ruinously expensive; one mis-aligned executive can burn months of runway.

“The real challenge today is not just working fast—it’s assessing talent accurately. You must find the right fit, not just the quickest solution.” — Janielle Newland, Founder, Newland Talent Advisors

From Enduring Partnerships to Transactional Deals

Historically, search firms commanded fees of 33–35 percent of first‑year compensation under fully retained mandates as C‑suite leaders forged deep, enduring partnerships with them. That premium bought far more than résumés—it delivered a partner able to decode an executive’s values, priorities, and leadership style.

Today, that model is under siege. Container and contingency searches ask for an initial retainer, with the bulk of the fee due upon placement—shifting risk to the firm and tempting cost‑conscious clients. In a muted hiring climate, even this hybrid is losing ground: top‑tier roles are now chased on a fully contingent basis as firms scramble for market share.

“The core of this system was trust—it was never just about filling a seat. It was about securing a leader whose values and vision would sustain the organization for the long haul.” — Janielle Newland

For decades, meticulous research, expansive networks, and rigorous vetting defined the relationship‑driven approach of executive search. Now, as AI platforms proliferate and democratize access to talent, the premium once reserved for this high‑touch service is steadily eroding.

The Digital Disruption

The rise of professional networks like LinkedIn—and AI‑driven tools such as HireVue and Eightfold—lets employers bypass third‑party recruiters and mine vast candidate pools on their own. What began as networking has evolved into a robust self‑service recruiting engine.

Newland notes, “Because LinkedIn is so accessible, everyone thinks they’re a recruiter now. We’ve drifted from the deep work of understanding both candidates and companies. The emphasis has shifted to speed—often at the expense of insight.”

While algorithms can parse keywords and match job specs, they routinely overlook the intangibles: culture, leadership potential, and the nuanced traits that separate a solid hire from a transformational one. Virtual interviews via Zoom or Teams accelerate cycles, but obscure the subtle in-person cues that seasoned search partners once relied on.

Where We Stand Today

“Economic pressure forces firms to cut corners, but it always catches up with them,” Newland cautions. A crowded marketplace—spanning global giants to boutique agencies—makes it hard for clients to distinguish true strategic advisors from résumé shufflers. The result: executive search has become commoditized, and industry standards have blurred.

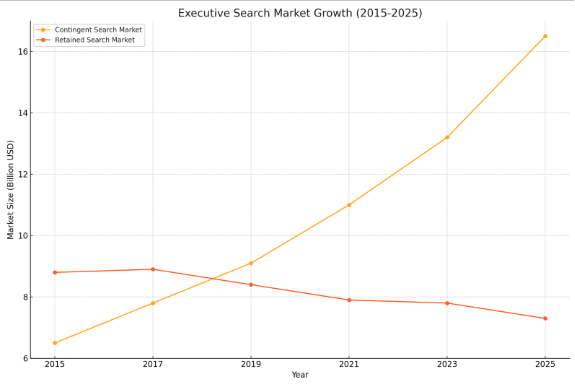

Data Spotlight: The Shifting Landscape of Executive Search in Tech and Biotech

The executive search industry has evolved dramatically over the past 10 years driven by economic pressures, digital disruption, and changing client demands. Here are three key trends reshaping the field:

- Market Shift Toward Contingent Models:

The overall executive search market has grown from $15.3 billion in 2015 to a projected $23.8 billion in 2025, with contingent search nearly doubling to $16.5 billion over this period, while traditional retained search loses ground (Statista, 2025). - Digital Disruption:

AI-driven platforms and professional networks like LinkedIn have streamlined recruiting but often miss critical factors like cultural fit and leadership potential, contributing to higher turnover (Deloitte, 2024).

Takeaway: While the overall “search” market is growing, fully retained models have declined in favor of contingent and hybrid models like container search.

“Technology makes it easier to find people, but judgment, intuition, and understanding what truly drives talent can never be automated.” – Howard Schultz, former CEO of Starbucks

As the industry adapts to economic pressures, technological advancements, and shifting client expectations, it is essential for firms to strike a balance between speed and depth in their recruitment processes. “Ultimately,” says Newland, “we need to reassess what’s truly valuable in an executive search, and how we can bring back the depth and rigor to the process that’s been lost. That’s the real challenge we’re facing now.”

Conclusion: Adapt, Evolve, Lead

In a landscape defined by speed and disruption, the firms that thrive will be those that evolve without losing sight of what matters – deep relationships, rigorous vetting, and a commitment to quality. This is the true challenge of modern executive search – not just moving fast, but moving with purpose.

“True leaders are not discovered by algorithms or databases – they emerge through the careful assessment of character, purpose, and potential.”-Bill George, former CEO of Medtronic

As the industry continues to transform, those who strike this balance will set the standard for a new era of leadership.